Partial Dispute

I worked on this project aimed at revolutionizing the credit card dispute process within the online banking platform. The objective of the project was to introduce partial amount disputes functionality to the RBC online banking platform, addressing a substantial volume of customer calls related to this feature's absence.

Problem Statement

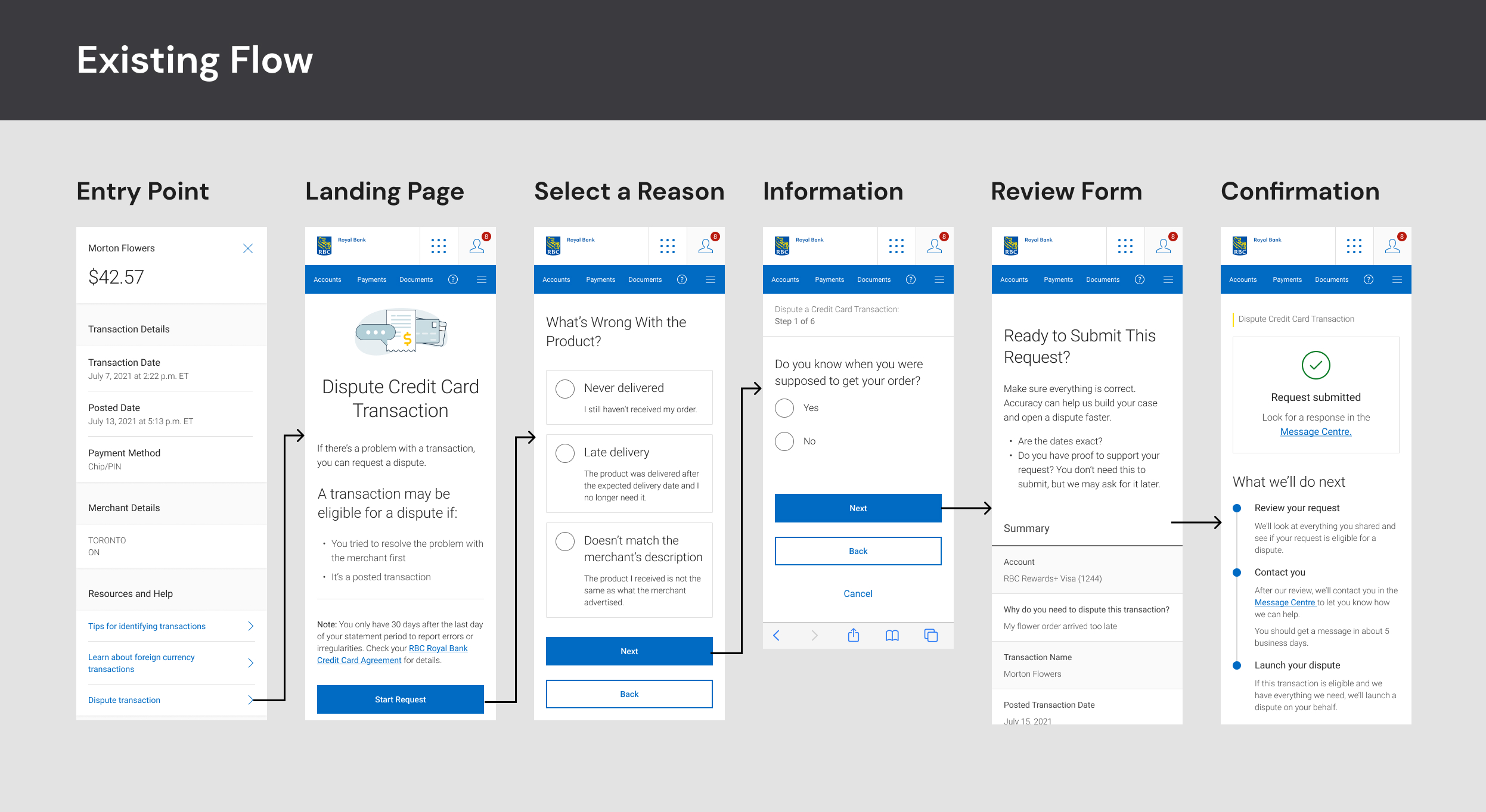

The existing online banking platform only supported full-amount disputes. This led to an influx of customer inquiries regarding partial amount disputes, prompting the need for an intuitive and user-friendly solution.

Research and Discovery

InterviewsTo gain insights into the issue, we conducted interviews with Subject Matter Experts (SMEs) to understand pain points and gathered insights on the existing process.

User FeedbackAnalyzed customer feedback and call logs to identify common scenarios for partial disputes.

Approach

Explored potential flows and touchpoints for introducing partial disputes. Developed two distinct flows: Light and Heavy versions based on the development effort required. We ended up going with light version.

Light Flow

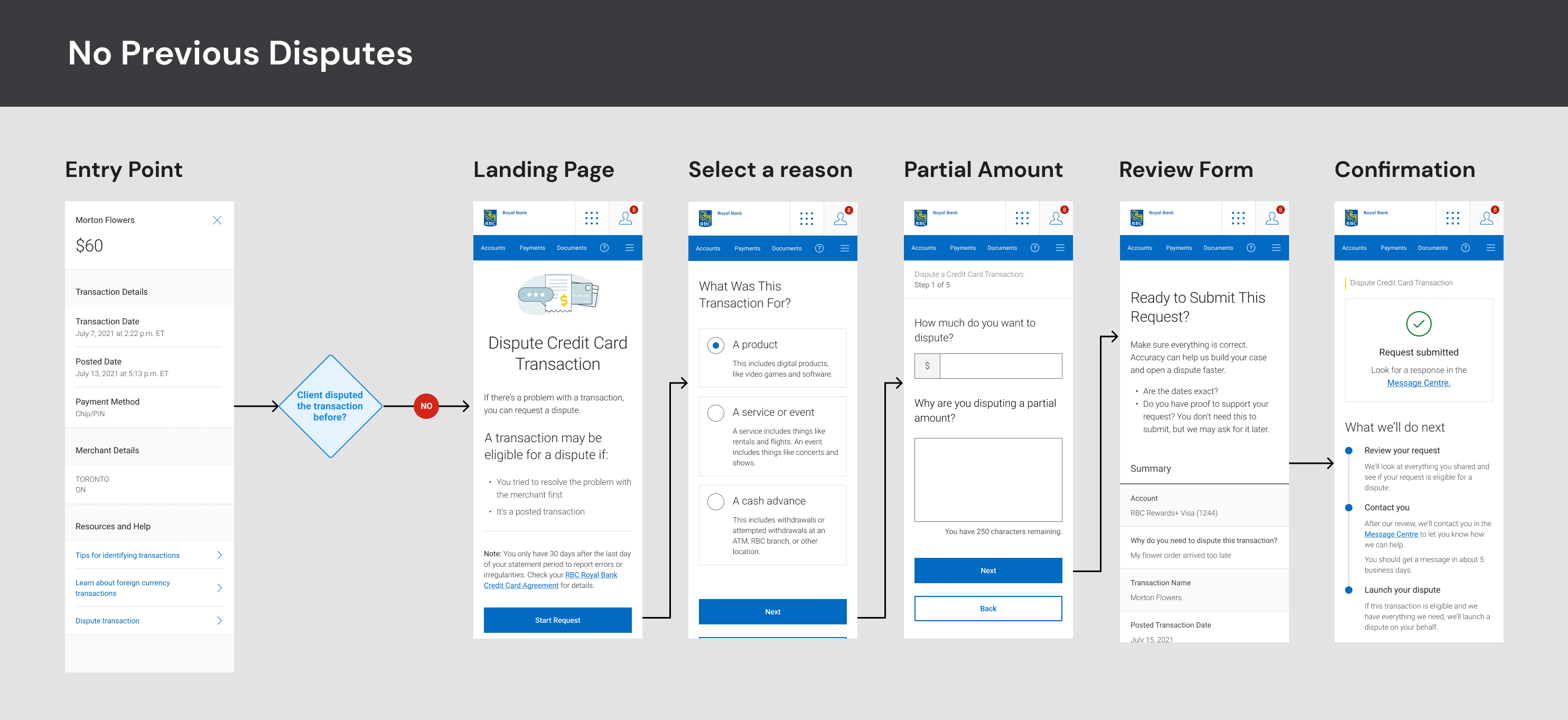

Step 1: Transaction Detail Panel

- Has the client previously disputed this transaction?

- Has the merchant applied for credit for this transaction?

- If the client hasn't disputed this transaction before, they are directed to a landing page providing an overview of the process and legalities. They are then prompted to choose between a full or partial dispute.

- In case of a partial dispute, clients specify the disputed amount.

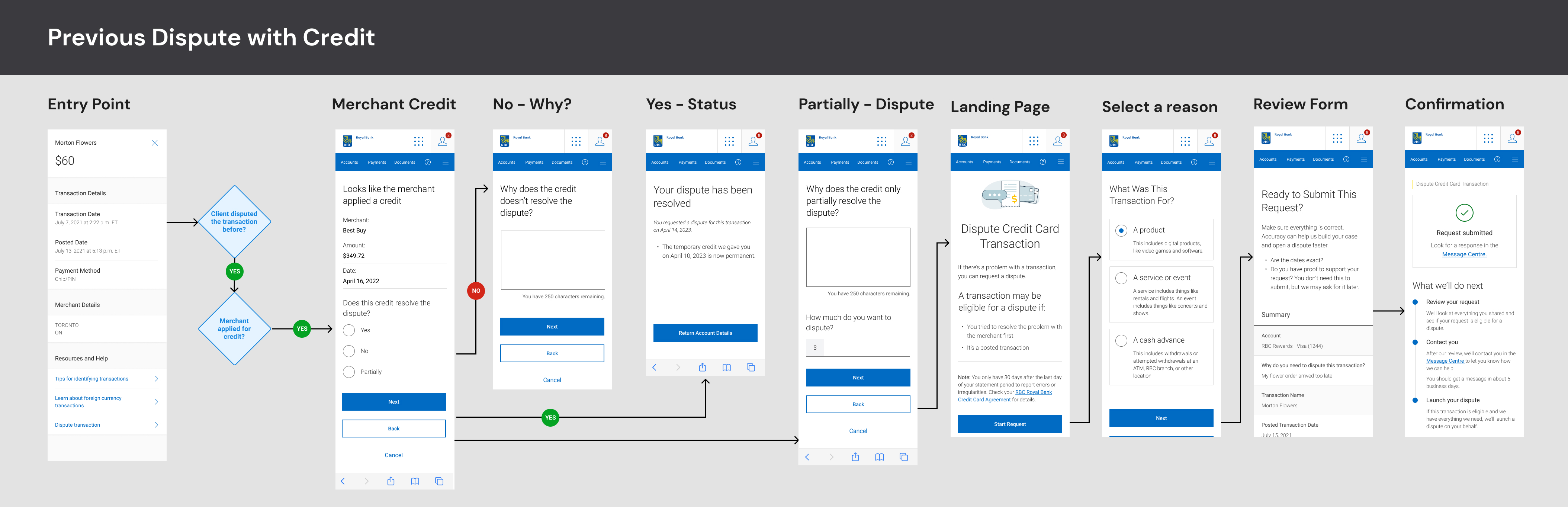

- If the client has previously disputed the transaction and received credit from the merchant, we display that information. The client is given the option to indicate if the credit resolves the dispute.

- If the credit does not resolve the dispute, they provide a reason and our SMEs initiate a follow-up call.

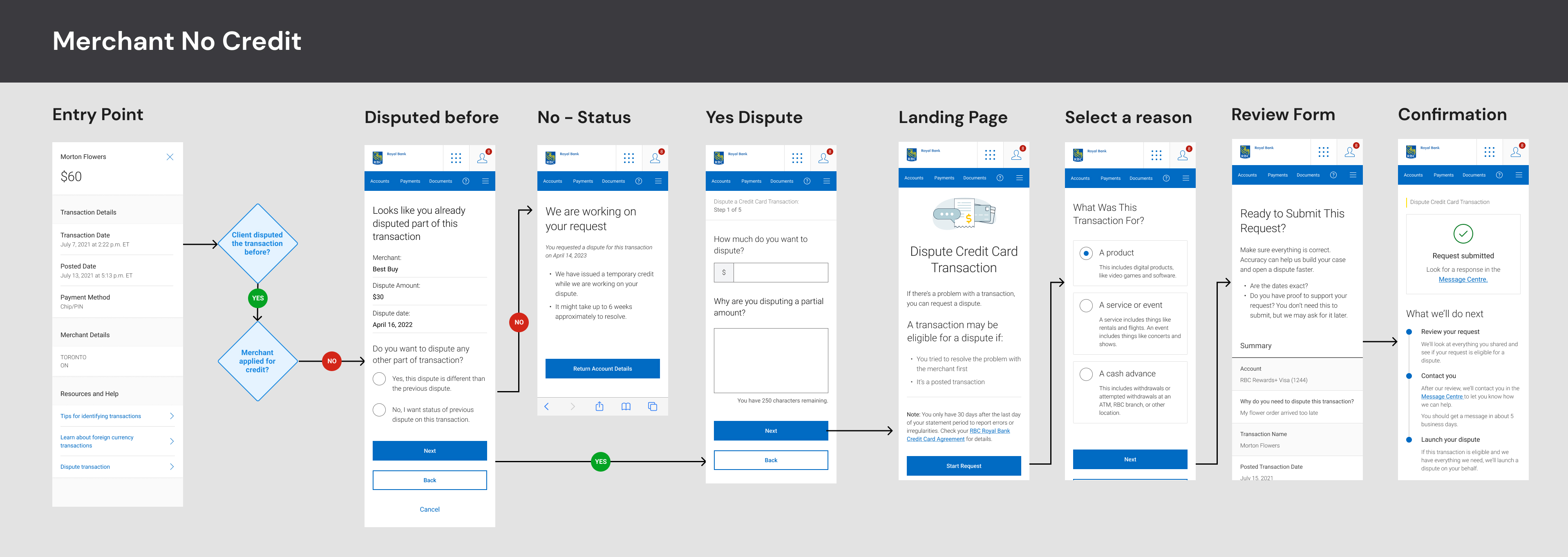

- If the merchant hasn't applied for credit, the client decides if they wish to file another partial dispute for the same transaction or inquire about the status of the previous dispute.

Heavy Flow

This encompasses all steps in the Light Flow, with an additional check for the amount of credit applied by the merchant. If full credit has been applied, the dispute is automatically declared resolved. This was done to reduce cognitive load on client side.

Results

The introduction of partial amount disputes significantly streamlined the process for RBC's online banking clients. By providing them with more control and flexibility, we saw a substantial reduction in call volumes related to partial disputes, enhancing overall customer satisfaction.

Impact

+3.4%

“Iterative working process is the only way to ensure your design will be a precise fit."